The 5-Second Trick For Public Insurance Adjuster

Table of ContentsSome Known Questions About Public Insurance Adjuster.Unknown Facts About Public Insurance AdjusterOur Certified Public Adjuster Statements

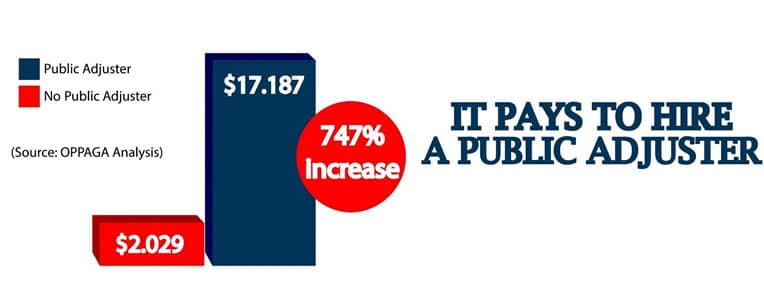

A public adjuster is a professional insurance claims handler/ cases insurer who advocates for the policyholder in assessing and also working out a claimant's insurance coverage claim. Apart from lawyers and the broker of document, state certified public insurers can lawfully represent the civil liberties of a guaranteed throughout an insurance policy claim process. Their technical experience as well as ability to analyze in some cases uncertain insurance coverage enable home owners to get the maximum quantity of indemnification for their insurance claims.Lots of specialists, as well as persons that are either unable as a result of education and learning, age, or physical impairment, pick public adjuster depiction to guide them via the procedure and also decrease the time which has to be invested to excellent their claim. Many public insurance adjusters bill a percentage of the settlement. Mostly public adjusters review your insurance coverage to establish if there is coverage for the loss, evaluate the cause of loss which will certainly activate protection, prepare in-depth range as well as price quotes lot of times using professionals in the fields of remediation, toxicology, as well as construction engineers to verify their loss.

Outside the USA insurance adjusters are typically called (or translated into English as) "insurance coverage loss assessors" (or just "loss assessors") and also personnel insurance adjusters or independent adjusters are called or translated as "insurance loss insurers" (or simply "loss insurance adjusters"). However, there is a clear distinction between a loss insurance adjuster, who services behalf of an insurance provider, and also a loss assessor who functions on behalf of a policyholder.

The states that do not are: Alaska, South Dakota, as well as Wisconsin. Additionally, it is essential to keep in mind that on October 14, 2005, the National Association of Insurance Coverage Commissioners (NAIC) embraced the general public Adjuster Licensing Model Act (MDL-228), which governs the credentials and also treatments for the licensing of public adjusters - Certified Public Adjuster.

What Does Certified Public Adjuster Do?

The burden of presenting a professional insurance claim to an insurance company can be reduced by the job of a public insurance adjuster. Plan holders that are not properly indemnified by their insurance providers may be entrusted little option but to work with specialist aid to recuperate the claim repayment to which they are qualified.

The day-to-day meanings of terms like "collapse", "partial collapse" as well as "level of physical damage" may be completely various from their lawful analyses, needing the adjuster to clarify such terms for the client. Regulations regarding usings these terms are regularly in a state of flux so it is necessary for public insurers to have a strong grasp of the legislation including the department of lawful responsibilities between insurance provider and also insurance holders.

For instance, one Georgia business specifies their average fee is 20% based on the type and quantity of the insurance policy case [citation needed] Nonetheless, reduced percentages are made use of for bigger losses being declared under a policy of insurance. Higher portions are needed for smaller asserted losses. Smaller sized insurance cases can have comparable prices as bigger insurance claims, however because the recuperation is less on smaller claims the fee variety have to be gotten used to make up for the operating expenses.

Fascination About Public Adjuster

Skills of efficiency can differ considerably between public insurers varying from basic to elite expert. Public Adjuster NJ. Charges of 15% to 20% are normal and common for declared losses of $100,000 or higher when managed by standard-rated public insurance adjusters. Expert-rated public insurance adjusters obtain a greater charge than standard-rated insurance adjusters. For instance, an expert public adjuster can charge 18% to 20%+ on a loss that surpasses $100,000.

Some public insurers charge a flat percent or a flat cost established cost, while others use a regressive range. It depends, partially, on the State Law where the loss happened. As an example, a regressive scale can be 25% of the first $100,000, 20% in between $100,001 and $200,000, as well as 15% of any type of quantity past that.